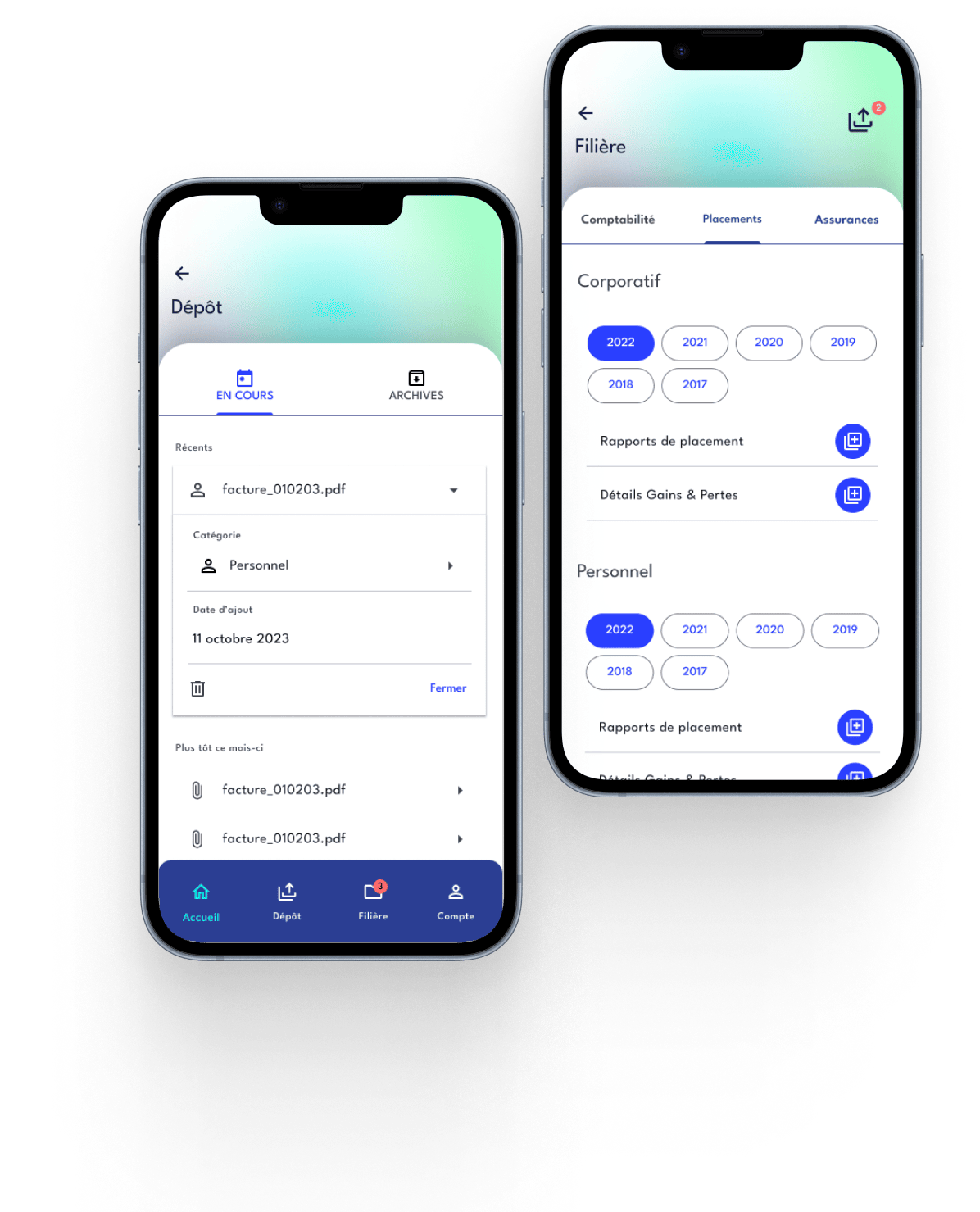

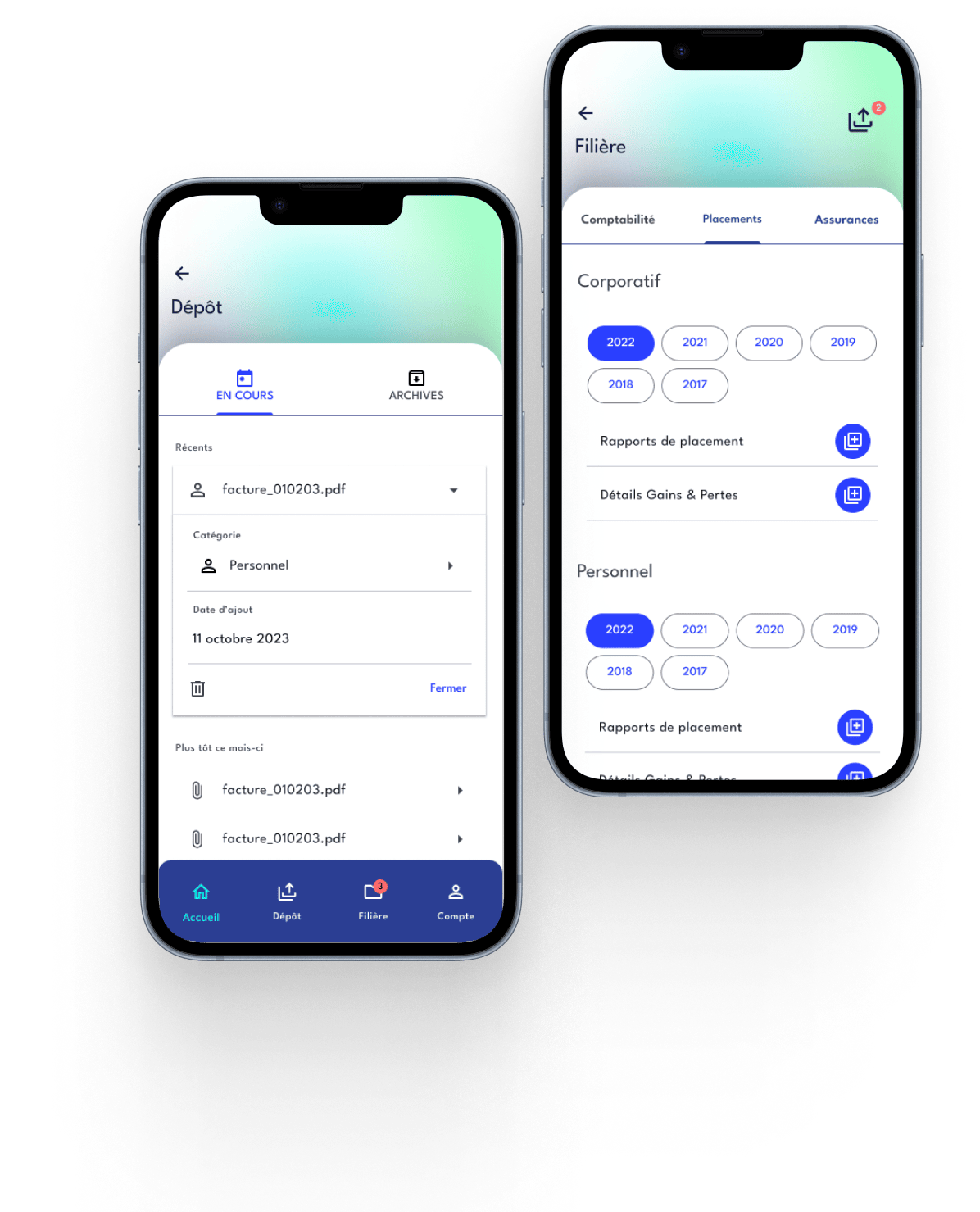

Simplify your financial management with Monetori

Monetori is a financial consulting firm that brings together accounting, investments and insurance in an integrated model, powered by its innovative digital solution to transform the way you manage your finances.

Give your priorities a boost, we will take care of your finances.

With Monetori you get :

Let us simplify your financial management. Register and receive an invitation.

How to register :

Download application

Via App Store or Google Play, download the app onto your cell phone or tablet

Apply online

Click on the Make a request button and complete the short form.

Receive an invitation

You will receive an e-mail inviting you to make an appointment with our team of professionals.

Services

Monetori offers a range of services tailored to your specific needs.

You'll no longer have to coordinate meetings between your professionals, since our team of experts in accounting, investments and insurance offers an integrated, turnkey service that will facilitate your day-to-day financial management.

Accounting

- Bookkeeping

- Production of financial statements (annual, quarterly or monthly) according to your package

- Filing of personal and corporate provincial and federal income tax returns

- Accounting and tax consulting services

Investments

- Comprehensive financial planning

- Portfolio analysis and optimization

- Tax strategies

- Private portfolio management

- Performance monitoring

Insurance

- Insurance strategies

- Estate planning

- Insurance as a tax-efficient investment vehicle

- Access to your insurance contracts via the application

Save time and stay organized

Our customers

Thanks to its integrated approach and innovative digital solution, Monetori supports professionals, business owners and families in every one of their financial decisions.

Professionals

- Business professionals (accountants, lawyers, engineers, etc.)

- Healthcare professionals (doctors, pharmacists, etc.)

Business owners

- Small business owners

- Owner of a management company

- Self-employed

Families in business

- Family owning and managing a family business

Monetori offers you an integrated solution that's secure, fast and accessible at all times.

Contact one of our professionals for a turnkey service.

Our rates

At Monetori, it pays to bundle your services1. Here are our proposed accounting management rates for customers with the integrated service package.

Plus, test our slider to see what your monthly payment would be based on your assets under management with Monetori. Your accounting costs could quickly drop to zero ***

Start-up

monthly payment 2

most popular

Diamond

monthly payment 2

VIP

monthly payment 2

1 The above rates are conditional on the integration of all services (accounting, investment and insurance).

2 Plus taxes

3 This includes the health professional's, business families and company owers (SME) personal declaration. Additional charges may apply for family members.

4 Any consultation exceeding the number of hours offered in the package will be billed at an hourly rate of $300 CAD. 30-minute consultation.

*** Based on net assets under management at December 31 of each year. Cash back at the beginning of each calendar year.

About us

With over 20 years' experience in their respective fields of expertise, Philippe Bouchard (CIMMD) and Yann Morin Perrin CPA have decided to combine their strengths and expertise to offer a range of integrated services to their targeted customers via Monetori, a virtual application combining accounting, investments and insurance.

The mission is to simplify our clients' by centralizing all aspects of their financial management in a virtual filing cabinet that is accessible at all times, so that their customers can enjoy their day-to-day lives with complete peace of mind.

On the long term, our vision is To transform the client experience in the financial sector through an integrated and innovative approach that redifines how individuals engage with their finances.

Our corporate values are embodied in every one of our actions and decisions, and serve as a guideline in everything we do. These are indispensable to us, and are at the heart of the service we offer.

Integrity

Performance

Collaboration

FAQ

Do you have any questions about our services and their financial aspects?

See our Frequently Asked Questions and our integrated glossary for more information.

What tax accounting services does Monetori offer?

- annual financial statements

- provincial and federal tax returns (personal and corporate)

- several hours with our professionals on an annual basis

- joint presentation of financial statements and annual reports on investment portfolios, for an overall view of your situation

- bookkeeping with quickbooks

- consultation with a tax specialist if necessary

With our securities brokerage license, we offer our customers the highest level of protection available in Canada, as a member of the Canadian Investor Protection Fund (CIPF). https://www.fcpi.ca/accueil

This means that, in the event of the insolvency of our broker member "Patrimoine Aviso" (which is owned by Desjardins Group), you benefit from the following protections:

Limits for individuals

In the case of an individual who has opened one or more accounts with a member broker, the limits of FCPI protection are generally as follows:

- One million dollars for all general accounts (including cash accounts, margin accounts, TFSAs and TFSABSAs), plus

- One million dollars for all registered retirement accounts (including RRSPs, RRIFs and LIFs), plus

- One million dollars for all registered education savings plans (RESPs), provided the client is the subscriber.

Limits for your medical corporation

A medical corporation is a joint-stock company that, having opened an account with a member broker, will benefit from one million dollars of protection for all accounts opened with Monetori.

Our advisors are licensed by the AMF (Autorité des Marchés Financiers) as financial security advisors. This means that Monetori offers you solutions in personal insurance, covering life insurance, disability insurance and critical illness insurance.